What Is The Property Tax Exemption For Over 65 In Alabama . Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. Web homeowners over 65 who have an adjusted gross income on their most recent state income tax return of $12,000 or less can claim a principle residence exemption from all county and municipal property taxes, regardless of the assessed value of their property. Web property tax exemption q&a is the special senior exemption a full exemption for everyon. Web if you are over the age of 65, reside in the state of alabama and your taxable income on your federal income tax. 65 years of age or older? Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt.

from lowcostcelestronc8.blogspot.com

Web homeowners over 65 who have an adjusted gross income on their most recent state income tax return of $12,000 or less can claim a principle residence exemption from all county and municipal property taxes, regardless of the assessed value of their property. Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt. Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. Web if you are over the age of 65, reside in the state of alabama and your taxable income on your federal income tax. 65 years of age or older? Web property tax exemption q&a is the special senior exemption a full exemption for everyon.

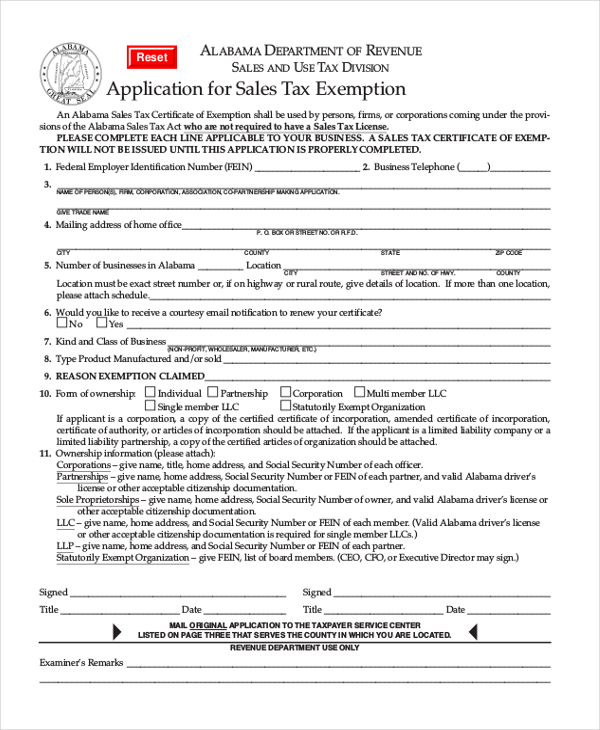

30++ How Do I Apply For Tax Exempt Status In Alabama ideas Info Anything

What Is The Property Tax Exemption For Over 65 In Alabama Web homeowners over 65 who have an adjusted gross income on their most recent state income tax return of $12,000 or less can claim a principle residence exemption from all county and municipal property taxes, regardless of the assessed value of their property. Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. Web if you are over the age of 65, reside in the state of alabama and your taxable income on your federal income tax. Web property tax exemption q&a is the special senior exemption a full exemption for everyon. Web homeowners over 65 who have an adjusted gross income on their most recent state income tax return of $12,000 or less can claim a principle residence exemption from all county and municipal property taxes, regardless of the assessed value of their property. Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt. 65 years of age or older?

From www.myxxgirl.com

Fillable Online Federal Estate Gift And Gst Tax Rates Exemptions Fax What Is The Property Tax Exemption For Over 65 In Alabama Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt. 65 years of age or older? Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. Web if you are over. What Is The Property Tax Exemption For Over 65 In Alabama.

From reeblaural.pages.dev

Ohio Homestead Exemption 2024 Form Lexis Lillis What Is The Property Tax Exemption For Over 65 In Alabama Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. Web if you are over the age of 65, reside in the state of alabama and your taxable income on your federal income tax. Web property tax exemption q&a is the special senior exemption a full. What Is The Property Tax Exemption For Over 65 In Alabama.

From discoverspringtexas.com

Reduce your Spring Texas real estate taxes by 40 with the homestead What Is The Property Tax Exemption For Over 65 In Alabama Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt. Web homeowners over 65 who have an adjusted gross income on their most recent state income tax return of $12,000 or less can claim a principle residence exemption from all county and municipal property taxes,. What Is The Property Tax Exemption For Over 65 In Alabama.

From www.hauseit.com

What Is the FL Save Our Homes Property Tax Exemption? What Is The Property Tax Exemption For Over 65 In Alabama Web if you are over the age of 65, reside in the state of alabama and your taxable income on your federal income tax. Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. Web property tax exemption q&a is the special senior exemption a full. What Is The Property Tax Exemption For Over 65 In Alabama.

From www.weld.gov

Senior property tax exemption available Weld County What Is The Property Tax Exemption For Over 65 In Alabama Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt. Web homeowners over 65 who have an adjusted gross income on their most recent state income tax return of $12,000 or less can claim a principle residence exemption from all county and municipal property taxes,. What Is The Property Tax Exemption For Over 65 In Alabama.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF What Is The Property Tax Exemption For Over 65 In Alabama 65 years of age or older? Web homeowners over 65 who have an adjusted gross income on their most recent state income tax return of $12,000 or less can claim a principle residence exemption from all county and municipal property taxes, regardless of the assessed value of their property. Web if you are over 65 years of age, or permanent. What Is The Property Tax Exemption For Over 65 In Alabama.

From pafpi.org

Certificate of TAX Exemption PAFPI What Is The Property Tax Exemption For Over 65 In Alabama Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt. Web property tax exemption q&a is the special senior exemption a full exemption for everyon. Web if you are over the age of 65, reside in the state of alabama and your taxable income on. What Is The Property Tax Exemption For Over 65 In Alabama.

From www.hauseit.com

What Is the Florida Homestead Property Tax Exemption? What Is The Property Tax Exemption For Over 65 In Alabama Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. Web property tax exemption q&a is the special senior exemption a full exemption for everyon. Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of. What Is The Property Tax Exemption For Over 65 In Alabama.

From www.signnow.com

California Property Tax Exemption Complete with ease airSlate SignNow What Is The Property Tax Exemption For Over 65 In Alabama Web property tax exemption q&a is the special senior exemption a full exemption for everyon. 65 years of age or older? Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. Web if you are over 65 years of age, or permanent and totally disabled (regardless. What Is The Property Tax Exemption For Over 65 In Alabama.

From www.exemptform.com

Alabama State Sales And Use Tax Certificate Of Exemption Form Ste 1 What Is The Property Tax Exemption For Over 65 In Alabama Web property tax exemption q&a is the special senior exemption a full exemption for everyon. Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. 65 years of age or older? Web if you are over the age of 65, reside in the state of alabama. What Is The Property Tax Exemption For Over 65 In Alabama.

From www.countyforms.com

Senior Citizen Property Tax Exemption California Form Riverside County What Is The Property Tax Exemption For Over 65 In Alabama 65 years of age or older? Web property tax exemption q&a is the special senior exemption a full exemption for everyon. Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. Web homeowners over 65 who have an adjusted gross income on their most recent state. What Is The Property Tax Exemption For Over 65 In Alabama.

From www.exemptform.com

Tax Exempt Form For Ellis County What Is The Property Tax Exemption For Over 65 In Alabama Web if you are over the age of 65, reside in the state of alabama and your taxable income on your federal income tax. 65 years of age or older? Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt. Web if you’re 65 years. What Is The Property Tax Exemption For Over 65 In Alabama.

From lowcostcelestronc8.blogspot.com

30++ How Do I Apply For Tax Exempt Status In Alabama ideas Info Anything What Is The Property Tax Exemption For Over 65 In Alabama Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt. 65 years of age or older? Web if you are over the age of 65, reside in the state of alabama and your taxable income on your federal income tax. Web homeowners over 65 who. What Is The Property Tax Exemption For Over 65 In Alabama.

From www.formsbank.com

Fillable Application For Sales Tax Certificate Of Exemption Alabama What Is The Property Tax Exemption For Over 65 In Alabama Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt. 65 years of age or older? Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. Web property tax exemption q&a. What Is The Property Tax Exemption For Over 65 In Alabama.

From yourrealtorforlifervictoriapeterson.com

Homestead Exemptions & What You Need to Know — Rachael V. Peterson What Is The Property Tax Exemption For Over 65 In Alabama Web property tax exemption q&a is the special senior exemption a full exemption for everyon. 65 years of age or older? Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt. Web if you’re 65 years or older, own and reside in your home, and. What Is The Property Tax Exemption For Over 65 In Alabama.

From pdfliner.com

ALA4 Alabama Employees Withholding Tax Exemption Certificate — PDFliner What Is The Property Tax Exemption For Over 65 In Alabama Web if you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt. Web homeowners over 65 who have an adjusted gross income on their most recent state income tax return of $12,000 or less can claim a principle residence exemption from all county and municipal property taxes,. What Is The Property Tax Exemption For Over 65 In Alabama.

From www.justinlandisgroup.com

[Guide] Greater Atlanta and Property Tax Exemptions for Seniors What Is The Property Tax Exemption For Over 65 In Alabama Web if you are over the age of 65, reside in the state of alabama and your taxable income on your federal income tax. Web property tax exemption q&a is the special senior exemption a full exemption for everyon. Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or. What Is The Property Tax Exemption For Over 65 In Alabama.

From www.formsbank.com

Fillable Form Rev 64 0002e Senior Citizen And Disabled Persons What Is The Property Tax Exemption For Over 65 In Alabama Web if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may. 65 years of age or older? Web property tax exemption q&a is the special senior exemption a full exemption for everyon. Web if you are over the age of 65, reside in the state of alabama. What Is The Property Tax Exemption For Over 65 In Alabama.